Cyataxes Realtors Tax Deductions Worksheet free printable template

Show details

Realtors Tax Deductions Worksheet

AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign worksheet realty deductions form

Edit your write offs for real estate agents form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your realtor deductions worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real estate write offs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deductions worksheet form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

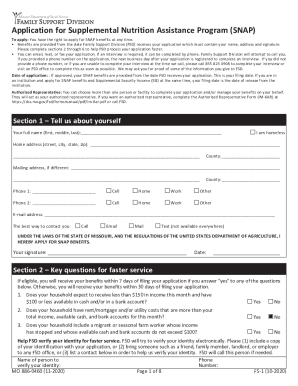

How to fill out worksheet realtors deductions form

How to fill out Cyataxes Realtors Tax Deductions Worksheet

01

Gather all necessary documentation related to your real estate business expenses.

02

Open the Cyataxes Realtors Tax Deductions Worksheet.

03

Fill in your personal information at the top of the worksheet, including your name and tax ID number.

04

List all eligible tax deduction categories such as advertising, car expenses, and office supplies.

05

For each category, enter the corresponding amount you spent during the tax year.

06

Calculate the total deductions by summing all entered amounts in each category.

07

Review your entries for accuracy to ensure you haven’t missed any deductions.

08

Save or print the completed worksheet for your tax records or for submission to your tax preparer.

Who needs Cyataxes Realtors Tax Deductions Worksheet?

01

Realtors and real estate agents who want to track and claim tax deductions related to their business expenses.

Fill

real estate agent tax deductions

: Try Risk Free

People Also Ask about list of tax deductions for real estate agents

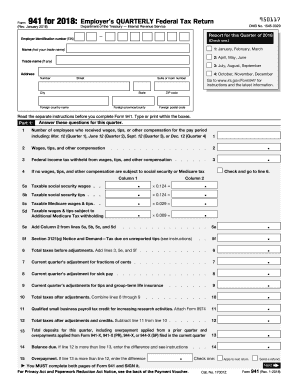

What is the standard deduction for real estate?

The standard deduction is set at these figures for the 2022 tax year: $12,950 for single taxpayers and married taxpayers filing separate returns. $25,900 for married taxpayers filing jointly and qualifying widow(ers) $19,400 for those who qualify to file as head of household3.

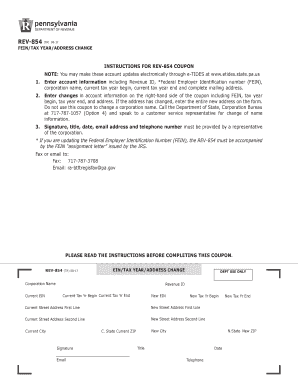

What IRS form do I use for property tax deduction?

To deduct expenses of owning a home, you must file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Income Tax Return for Seniors, and itemize your deductions on Schedule A (Form 1040). If you itemize, you can't take the standard deduction.

What are the IRS rules for real estate tax deductions?

Are property taxes deductible? Generally, yes. The SALT deduction allows you to deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales taxes.

What is tax deduction worksheet?

This worksheet allows you to itemize your tax deductions for a given year.

What are the IRS limits on property tax deductions?

As of 2021, California property owners may deduct up to $10,000 of their property taxes from their federal income tax if they are filing as single or married filing jointly. Unfortunately, any property taxes you have paid in excess of $10,000 cannot be counted toward your deduction.

What deductions can be taken on estate tax return?

What deductions are available to reduce the Estate Tax? Charitable Deduction: If the decedent leaves property to a qualifying charity, it is deductible from the gross estate. Mortgages and Debt. Administration expenses of the estate. Losses during estate administration.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my real estate tax deduction worksheet in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your worksheet realtors deductible along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find tax deductions for real estate agents?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the realtors tax deductions worksheet. Open it immediately and start altering it with sophisticated capabilities.

Can I edit realtor tax worksheet on an Android device?

You can make any changes to PDF files, like realtor tax spreadsheet, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Cyataxes Realtors Tax Deductions Worksheet?

The Cyataxes Realtors Tax Deductions Worksheet is a document that helps real estate professionals track their deductible expenses for tax purposes.

Who is required to file Cyataxes Realtors Tax Deductions Worksheet?

Real estate agents and brokers who incur business-related expenses are required to file the Cyataxes Realtors Tax Deductions Worksheet.

How to fill out Cyataxes Realtors Tax Deductions Worksheet?

To fill out the Cyataxes Realtors Tax Deductions Worksheet, one must list out all applicable deductions, including office expenses, marketing costs, travel expenses, and any other related costs, along with their corresponding amounts.

What is the purpose of Cyataxes Realtors Tax Deductions Worksheet?

The purpose of the Cyataxes Realtors Tax Deductions Worksheet is to provide a systematic way for real estate professionals to record and claim their tax deductions, ultimately reducing their taxable income.

What information must be reported on Cyataxes Realtors Tax Deductions Worksheet?

The information that must be reported on the Cyataxes Realtors Tax Deductions Worksheet includes detailed descriptions of deductible expenses, the amounts for each expense, and any relevant supporting documentation.

Fill out your Cyataxes Realtors Tax Deductions Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Worksheet Realty Deductible is not the form you're looking for?Search for another form here.

Keywords relevant to real estate agents tax write offs

Related to real estate agent tax deductions worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.